For the fifth year in a row, I am posting some information about our family's charitable giving. This is a time of year when we are focused on giving to others. A time when we spend time with, and give presents to, our friends and families. And a time to support charities that do meaningful work we believe in.

For more recent bleeps, you might want to read my prior posts from 2012, 2011, 2010, and 2009. In particular, the 2012 post has some tools and resources to find charities that are doing good work. These older posts lay out the "what, why and who" of our family's giving. If you are interested in similar issues, perhaps you will find some organizations you will consider supporting. If not, I still hope that this blog causes you to consider how you approach charity.

If you look over the earlier lists, you will see that there are some constants, and some changes. Some of these are because our family became concerned about a situation (Central Asia Institute), or found an organization that we felt did more effective work, or as with Envirofit, was no longer a charity after converting to a for-profit company. Also, this list is a reflection of five peoples' choices; we don't require agreement from everyone, as long as the organization is working in one of our areas of interest. So it's fair to say that some changes are the result of changing personal interests. As I look over the past years, there are some things I am proud of, and a few that make me squirm. But we aren't deleting anything from the past- risk free philanthropy is an oxymoron. We have made mistakes, and will continue to do so. Our journey is to continue to learn about what works, and, frankly, what works well and best fits with our objectives. My hope in sharing is that you might avoid a few of the mistakes we have made (though you will probably make your own).

Usually, I try to sprinkle in a little wisdom to this post about what I am learning and seeing in my work as a professional in the philanthropy field. But this year, my job is quite a bit easier, since Peter Singer just wrote an excellent article in the Washington Post on how to use your head in charitable giving. So, I think I will refrain from piling on the Bat-kid.

In any event, here are the charities we have supported in 2013:

A) Environment- because we still can't live without it. (~20% of funds)

The Nature Conservancy

Trees Water People (C)

350.org

Center for Collaborative Conservation* (C)

High Country News Research Fund* (C)

Natural Resources Defense Council

B) Health- because health is a cornerstone of development- it is hard to go to school or work if you are sick. (20% of funds)

Doctors without Borders

Mothers2Mothers

Against Malaria

Watsi*

C) Social/International Development- a catch all category for organizations that are pursuing innovative approaches to long term challenges. (~15% of funds)

One Acre Fund

Women for Women International

Nepal Youth Foundation

The Mission Continues

Seeds of Peace*

D) Education- done well, education moves the needle and makes society better. (~10% of funds)

Engineers without Borders (C)

Colorado State University (C)

Akili Dada

Valentino Achak Deng*

E) Local charities- look around… there are many needs in your community. (~35% of funds; all based in Colorado)

Food, Family Farming Foundation

Growing Gardens-Boulder

FoCo Cafe

Intercambio

Book Trust

Alzheimer's Association of Colorado

Senior Alternatives In Transportation

Food Bank of Larimer County

Rocky Ridge Music Center*

Humane Society of Boulder*

Some people want to know how much money we give, and I don't really think that is important. Many of these organizations accept donations of as little as $10, though they are always grateful for more. Several years ago, we signed on to "The Life You Can Save" commitment of 5% of our income to help people living in extreme poverty. In addition, we (obviously) support other causes, such as the environment and local charities, including pets (which Peter Singer likely views as frivolous, but it isn't his money). Let's just say it is enough money to put a significant dent in our pocket. I don't buy the "give until it hurts" philosophy, because it doesn't hurt. In fact, it's quite the opposite.

Once again, do good and be great at it. Happy New Year!

____________

* New in 2013

(C) based in Colorado

Saturday, December 21, 2013

Charity 2013

Monday, November 18, 2013

Entering the Entrepocene

I am still blogging, but over here. I will still post on occasion as BOPreneur; but mostly, I am excited to be working with Andy on something new (yet which definitely builds on this blog).

Tuesday, November 12, 2013

Go here...

to see a post from Andy Hargadon and me about designing businesses to have a higher purpose. Our title for the post was "Eight Design Goals for Going Beyond Sustainability," but I liked their title too.

It expands on my post SoCap post "unManifesto on Mattering."

Tuesday, September 17, 2013

Reading, Fighting and 'rithmetic... RCT battles

I don't often find myself on the same side of an issue as Jeffrey Sachs, but he has taken on the randomistas, and their use of Randomized Controlled Trials (RCTs) in development. As my bleeps know, I have some issues with RCTs as well. (See "If RCT's Could Kill" and "Is It Right to Have the Poor Pay?"). So while my reasons are different than Sachs's, we agree that RCTs are not necessarily a valid, or useful, way to evaluate development programs.

Round 1: New York Times article by Joe Nocera on Sachs

Round 2: Sachs responds

Round 3: Dean Karlan weighs in on Freakonomics site

While Sachs has been charged with being an "ineffectual utopian" by another development economist, William Easterly, I think the randomistas are dangerous utopians. And I prefer the company of ineffectual utopians over dangerous ones.

The randomistas have taken a tool appropriate to medicine, and applied it to cultural behavior, and appear to believe that it will have similar predictive ability. When one tests a medicine in Detroit, one can be fairly confident that it will also work (or not) in Delhi because people are genetically very similar. Not so with culture. Can one generalize to rural Brazil from tests of people's willingness to use free bed nets in Kenya, or on gender impacts of microfinance in India? If these programs do not work in these areas, they may be cause for caution, but they are not predictive of failure elsewhere. But the randomistas, and their followers, are quick to proclaim that these interventions don't work. Large scale damnations for petty sins.

Furthermore, it seems utopian to think that if people prefer to get something for free (like bed nets), that manufacturers will oblige by continuing to provide that something for free, forever. One has to consider the system over the long term. As Paul Polak has said well, we cannot "donate people out of poverty." Development needs markets, and markets need price signals.

This issue matters, and is this fight is among smart, experienced, well-intentioned and respected people. While it could seem like an academic debate, it has to do with real issues and real people. It isn't just a "wonk war." Which types of development programs work? Which don't? How does one test the effectiveness of a program? Can one predict whether a program that is successful in one area (or not) will be successful (or not) in another area?

These are multi-billion dollar questions, with potential effects on millions of people. Poor decisions based on improper analysis by "searchers" using RCTs can be more dangerous than development efforts by "planners" that ignore the needs and desires of the beneficiaries. Neither are optimal, of course, but one is worse. Dean Karlan states a concern for future children, and I do too. The ones that don't have the advantage of the mosquito nets, financial access, and cook stoves that might have been available to their families, but for the mis-use of RCT results.

Saturday, September 07, 2013

unManifesto on Mattering

My bleeps know I am not big on manifestos.* But after a few days hanging out at the intersection** of meaning and money (aka #SOCAP13) and hearing quite a bit about impact investing and social entrepreneurship, I thought I'd share a few thoughts on building things that matter.

This is not a manifesto. I am not trying to enlist anyone. I am hoping to provoke people into thinking a bit more about this topic. To go deeper than the tweets and sound bites. To think about some design goals (or constraints) for (re)generative ventures.

So, if you want to build something that matters:

It isn’t

just about developing and selling innovative goods and services.

It is

about developing and selling goods that are good and services that serve.

It isn’t

just about being a little greener by conserving a little energy, or recycling

paper coffee cups at the office.

It is

about radically redesigning your entire supply chain to dramatically reduce

waste, or better yet, transform it into an asset.

It

isn’t just about creating jobs.

It is

about creating meaningful work; with a fair, livable wage, and preferably,

ownership for all co-workers over time.

It isn’t

just about giving back to your community.

It is

about being embedded in your community, and creating deep, lasting commitments

to what makes it special.

It isn’t

just about creating returns for investors.

It is

about designing a business model that has impact, and if it requires investors,

providing them with reasonable returns, subordinated to the company’s mission. Owners own the mission, and it owns them.

If you've got a bit more time, I was on a panel that discussed some of these issues, and you can watch the video. This isn't easy stuff. It's hard work, and it's worth doing well. Good luck!

___________________

* I might feel differently about womanifestos, but that is another post

** and geographically speaking, right next door to a race of $100 million dollar toys, which is, again, another post.

Thursday, July 11, 2013

Unreasonable Perpetuation

Enjoying the Unreasonable Institute events this week. Yesterday, Ross Baird of Village Capital and I did a session for impact investors on their role (or shall we say obligation?) to perpetuate mission. For my regular bleeps, you know the background on this. For new readers, you might want to look at this post by me and this one by Ross and then this one.

Here's the deck:

Thursday, May 02, 2013

Weeding Out?

There was a great story on NPR yesterday about how Harvey Mudd College is addressing the gender gap in Computer Science. I'd nominate their skateboarding president, Maria Klawe, as an educational arsonist.

"A lot of universities have this kind of weed-out class," says Kate Finlay, a student at nearby Scripps College who's taking Lewis' course. "The first class you take is a weed-out class, and they are shocked by the fact they don't get any women at the end. But the only people at the end are the people who have been in computer camp since they were 5."My father told me this happened to him at medical school. And my colleague and fellow instigator, Bryan Willson, said he was told when he started engineering school: "look to your right, look to your left... by the time you graduate, only one of you will be here."

Which got me to thinking... what would the start of a "weed in" program look like. How might a program introduction be more inclusive... and less intimidating.

A start would be “look to your right, look to your left… these are colleagues… you are responsible to help each other thru the program, which won’t be easy, but will be worth it. Together you will explore what has come before you, and imagine what will come in the future. Then you will build it, together. The history of humankind at its best is not just a history of competition, but of cooperation and collaboration. We value and admire all 3 of these qualities, and by selecting you to be part of our program, we think you do too.”

The next step might be to say “look to your right, look to your left… who is missing? Why? As you embark on your education, remember how fortunate you are to be here, and consider whether you feel you have an obligation to fill another seat by reaching out to help others prepare for their education. We have a multitude of programs where you can work with younger students, mentor…. How will you define success during your academic career? Will it be based on building knowledge in your own head and capability in your own hands? or will it extend to building knowledge and capability in our larger community?”

Hugs would, of course, be optional.

Wednesday, May 01, 2013

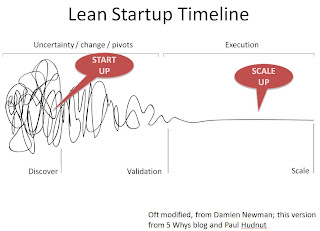

Picture (of) a Startup

Friday, April 19, 2013

Gifted.

This post was spurred by an article about my son, Peter, who has been high lining for seven years. But these feelings can be triggered by watching anyone who does something amazing. Where you pause and marvel at their grace and apparent ease in doing something difficult. They do things that were beyond imagination a short time ago.

Too often, we use the words "blessed" or "gifted" to describe these people. I think that is a mistake, and drives self-defeating behavior. In my observation, these aren't gifts- they are the results of hard work + passion (often bordering on obsession) + other experiences (often related) they bring to bear. And imagination. Sure, some people have more genetic predilection than others, but I have lived long enough to see these comets burn out. They may get a head start, but they rarely keep their lead if they don't have these qualities. None of which are inherited, and all of which can be learned, or at least chosen.

But rather than focus on the "gifted," let's focus on how we react to them. Do they make us jealous and resentful? (I admit I have felt this way more than once.) Or competitive? Or grateful and humble? When you see them, do you give up, knowing that you will never be that good? Do they fire your competitive juices? Or do you try to learn from them, hoping that they can help you perform better, even if you never reach their heights?

Next time you find yourself thinking that someone is gifted (your friend, competitor, colleague or kid), think about how hard they must have worked to make it look so easy. These talented people can inspire you to try harder, or provide the reality test that you may be better suited to other work.

The real gift of the "gifted" is that they can make you better, either at what they and you do, or at something entirely different. Perhaps, their gift will help you find the last piece of the puzzle that you need. The ease and power of an athlete, the use of color and space by an artist, the use of dissonance and improvisation by the musician, the surprising story of a writer.

So, what would you want to be gifted in? And how are you going to do that? Who should you read... watch... listen to... talk to? What is their gift to you? How will you use it?

And who might that help?

Thursday, April 18, 2013

Salvation Through Redemption?

What follows below is an ill formed idea. It has been sitting in my brain for a while, and doesn't seem to be getting any better with age (some ideas do). So it is time to throw it out there and see what my bleeps think.

Something has been bothering me about impact investing: what if, in the end, it doesn't matter?

As a field, we are spending a lot of time now defining who is a worthy social entrepreneur, determining how to best measure impact and trying to attract funds to this emerging sector. Excitement is high. And yet... to continue a somewhat imperfect metaphor... what if we are covering the tuition and fees for a brilliant student doing a combined degree in social work, environmental science, and international development, only to see them take a job with a Wall St bank when they graduate? And, even worse, what if the way we are supporting them drives them to have to take such a job? Does the way we fund social enterprises doom them to mission drift as they grow up?

As I have pointed out in previous blogs, some of the things that drive financial investment may create a tension with impact. Like seeking liquidity (or "exit"). If a company is financed by impact investors, who also desire to get their money back at some point,* it will likely be taken public or acquired. When that happens, its new owners are likely to care less about its mission than those impact investors. And this is likely to occur when the company really starts to reach scale and sustainability. So, Social Enterprise X (what an appealing acronym) experiments and pivots its way to a solid business model. Revenues grow, and profits arrive. They have reached the promised land of social enterprise. Except their investors want their money back. As a friend and mentor said to me last week, "perhaps liquidity is the original sin of impact investing."

My pessimism lifted this past fall as I worked on a transaction where, instead of an IPO or an acquisition, liquidity was obtained for New Belgium Brewing's founders and other owners through an ESOP buyout. Here, there was a stronger chance of mission perpetuation over the long term, as the mission rested with the employees who got the business to where it was, and who believed strongly in its mission and values. A chance for legacy, as well as liquidity.

Yet New Belgium had financed its growth through bootstrapping and debt, not equity. In a conversation with Ross Baird a few weeks ago, he asked me about how we might design in, from the beginning, a structure that could allow entrepreneurs to use equity and still not "sell out" their mission as they grew. Ross cares deeply about this issue, as his firm, Village Capital, is supporting young social enterprises around the world. If the answer was "it doesn't work if you take outside equity", then it wasn't an acceptable answer for Ross. Over the course of a few golf holes and then a few beers, an idea emerged.

Staying at a fairly high level, and trying to keep the math easy, it goes like this:

1) Entrepreneurs could build in an option into all funding rounds that would allow them to redeem** their shares for specific types of transactions that would provide long term mission perpetuation (for instance, full ESOP buy out, or conversion to a cooperative).

2) Investors would agree to a price for that option equivalent to an enterprise value based on a multiple of EBITDA (or cash flow) that would allow for the company to borrow enough money to pay off the investors. This would not work for investors seeking solely financial returns, but could work for those interested in a blend of return and impact.

3) This would not prevent a company from deciding to go public, or be acquired by a larger firm. But it would allow a successful and profitable company to pursue a different path. All involved would take a lower price than might be available for a more traditional liquidity event; but they would also have the satisfaction of seeing the enterprise continue on the impact path which they originally supported.

What might these multiples need to be? Well known venture investor, Sir Ronald Cohen has written that he thinks that funds will flow into impact investments if the returns were "around 7%." And I have met with PE firms that are willing to structure equity deals with repurchase obligations based on EBITDA multiples. Earlier rounds might have to be at higher multiples (to deal with the longer time frames and greater patience of their capital). But in round numbers, if a company has strong cash flows and reasonable margins, it could redeem its investors at 6-10x EBITDA multiples, and cover the debt required to finance such a repurchase. For investors, this should represent a return on "winners" (though not the legendary 10x) sufficient to drive a 7% or more return across an impact investment portfolio.

Perhaps, through the broader use of such redemption clauses (and/or other innovations), salvation is possible for impact investing. If we can't solve the puzzle of liquidity and legacy, I fail to see how the sector will truly differentiate itself from traditional venture investing or how it will ever live up to its claims of addressing the world's biggest challenges.

So, bleeps, what do you think? If you are an investor, would you agree to such a redemption right? If you are an entrepreneur, would you find this interesting (remember, you would get less $$ too)? And for my academic friends, have I forgotten the second law of something or other? Fire away....

___________________

If you have read this far, you may want to keep reading my prior post Kickstarter and Long Shadows.

* is any capital infinitely patient? should it be?

**Bruce Campbell has advocated that redemption clauses offer an exit alternative, and should be more common in impact investments.

Tuesday, March 19, 2013

Kickstarter and Long Shadows

I have mentioned in the past the "long shadow" that funding decisions cast into the future of a startup. These decisions often set an irrevocable path for startups, one that new founders often don't understand until they have lived through it once. It happens to many entrepreneurs, with perhaps Steve Jobs being the best know example of being dumped by the company he co-founded. But it isn't just the risk of being fired that should concern the entrepreneur. They should also be concerned about the mission of the company. To reframe, it isn't about you, it is about the ability of the company to perpetuate its purpose. Good founders understand that it isn't the funding that matters, it's the funders. More specifically, their values, expectations and commitments.

These values, expectations and commitments will largely revolve around recouping the investment and a return. That is what investors do. If they put money in, at some point they will want to get it back, plus a return. While they may appreciate the purposes set by the founders and see these as fundamental to building value, those are not the primary purpose of the funders. In the end, it is about harvesting their share of the value. If it is a fund, they are required to do this, usually within 10 years of accepting money from their investors. Don't get me wrong, good investors work hard to increase the value of the firm- serving on boards, helping recruit talent, helping forge partnerships. But they are doing it so they get their money back. Even in impact investing, they are investors. If they don't want their money back, they are philanthropists, not impact investors.

I was thinking about this as I read today's Fast Company article about Kickstarter, and a great series of recent blogs by Rafe Furst on "Why Crowdfunding Changes Everything." In the Fast Company article, one of the co-founders, Perry Chen, states "This is a founder-controlled company. Our investors understand that we want to stay independent forever. We have no intention of selling this company or doing an IPO." This is interesting, given that their venture round was led by Union Square Ventures, Fred Wilson's firm. Yep, the Fred Wilson who wrote a few years ago about the need for alternatives to acquisitions and IPOs to provide liquidity for founders and investors. His main concern was the tailing off of innovation in these firms after these events. But lurking between the lines of his post was the concern that, by investing (which requires liquidity at some point) he is part of the problem. His investment, in effect, will eventually lead his most successful portfolio companies to do something that will reduce their innovation, and by necessity, their value.

The Fast Company article goes on to say that the investors accepted a requirement to "never sell their shares." Let's peel that back a bit. That means, as Chen said, that company sale and IPO are non-starters. It also seems to rule out Fred Wilson's idea of an alternative market where Union Square could sell their shares, but allow Kickstarter to remain private and independent. I'd have to speculate that the options for the investors are either that Kickstarter eventually pays a dividend (and that would need to be at a high rate to meet VC ROI requirements during the term of their fund), or that there is some repurchase formula, where the company could recapitalize and buy-out its outside investors. My guess is that it is the latter, and that will mean Kickstarter ends up with a lot of debt, or a private equity investor. Either will change Mr. Chen's life significantly, I'd wager.

Another potential path besides the "never sell out" path is exemplified by Facebook. They did go public. But the founder, Mark Zuckerberg, maintained control by issuing two classes of stock. One class retains voting control with the founders. He borrowed this idea from Google, and LinkedIn, Zynga and others have also done it. As James Surowiecki wrote in the New Yorker, "whereas the CEOs of most public companies have to spend time kowtowing to investors, Zuckerberg and his peers are insisting on the right to say 'Thanks for your money. Now shut up.'" Perhaps these choices were made to avoid Steve Jobs's fate. Or perhaps they were made to see if the company can maintain an innovative, risk tolerant culture. To maintain the option to perpetuate the company's purpose.

The road is littered with companies that lost their purpose (or at least shifted their mission away from social and environmental aspects) as they grew and needed to meet investor requirements. Ben & Jerry's, Tom's of Maine, Burt's Bees, Honest Tea. Too often, mission driven companies get bitten by their shadow. The naivete that makes one take on the world with a risky venture is often accompanied by the Achille's heel of lack of knowledge of the implications of early decisions. The entrepreneur raises money to grow and increase their impact and brand, but in the end, the cost of that capital is a loss of their core mission. Valuation trumped values. But not always, and not forever. Ben & Jerry's recently became a B Corporation. Zappo's culture continues to thrive. Stoneyfield Farms seems to have kept most of its mission intact.

As I wrote several months ago, at New Belgium, we have tried a path of 100% employee ownership to perpetuate the company mission for the long term, and were able to provide the founders with liquidity over time. However, I don't think this would have been likely if the company had raised outside equity in the early days.

If companies want to retain the ability to pursue their purpose, they will need to make intentional decisions on funding and funders. For some, it may be better to bootstrap, and grow more slowly than would be possible with outside capital. Others will use debt (carefully). Others may choose a non-profit structure (although this isn't immune from mission shift), or investigate alternative structures like the ESOP or cooperatives where customers, employees or producers are the owners (REI, Namaste Solar, Organic Valley). Others may find, as Kickstarter has, funders willing to invest patient capital. And others will invent a new way, based on the disruption that Kickstarter and their ilk have brought.

All in all, the funding process should become more democratic and transparent, and that means the shadows should get shorter and less mysterious for entrepreneurs.

Sunday, March 10, 2013

Billions Saved (not "touched")

The field I work in is obsessed with impact. How will an organization make a measurable difference on a problem that matters? Unfortunately, this sometimes leads to silly math. Claims of "lives touched," whatever that means.

Sometimes, it is useful to step back and think about those that truly had an impact. Rather than lives touched, let's talk about lives saved. Here are a few examples.

Ignaz Semmelweis - first person to worry about germs in hospitals, when he noticed the number of women dying after childbirth. Turns out doctors weren't washing their hands. This was over a hundred years ago, so problem solved, right? Sadly, no. Hand washing and disinfection, (or lack thereof) is back in news with recent CDC "super bug" warnings. Semmelweis did not live to see the triumph of his ideas. He died after being beaten by guards in an asylum.

Norman Borlaug, who was central to the green revolution in agriculture. He won the Nobel Prize, and is credited with saving a billion lives.

Edward Jenner, often called the father of immunology. He was a pioneer in inoculation and vaccination, and is credited with proving effectiveness of early small pox vaccine. Historically, it had a 30% fatality rate, and millions were infected. Centuries later, smallpox was eradicated in the early 1970's by the WHO.

Alexander Fleming discovered penicillin, which led to broad use of antibiotics to treat disease. He also won the Nobel Prize. Not every dose saved a life, but many did. And we use a lot of antibiotics these days... estimates are 190 million per day. Which causes other problems. (This is an example of over-adoption of an innovation.)

What can we learn from these examples of impact? Bake your impact into your products and services. An ounce of prevention is worth at least a pound of cure. Measure real impact. Tie your metrics to your purpose. Income produced. Acres farmed with organic methods or reforested. Cases treated. Births without HIV infection. Lives saved.

Direct causation (or correlation) is often hard to establish when you work on prevention, but work toward it, not away from it. Impact is too important to dilute with silly math and a meaningless competition on "lives touched."

_______

If you like big numbers, you might be interested in these other blogs of mine: 3 Billion Served and Logistics, Legacy and Large Numbers

Of note, if you want to save billion of lives, you are living at the right time. For a few reasons. First, many people are living now versus the past (Banks estimates "about one person of fifteen who have ever lived is currently living"). And the pace of innovation and dissemination is much higher than in the past.

Thursday, March 07, 2013

What Will "College Town" Mean in 2025?

Fort Collins is proud of its recent ranking as a top "college town." Recently, I have been wondering what a "college town" will look like in 2025, so the article in our local paper provoked this short post.

I have blogged about this before- education (including higher education) is being disrupted. I don't know how this will evolve, but wonder if Fort Collins and other cities on this list are thinking about the second half of Schumpeter's creative destruction? What will a city need to do to attract creative, innovative people and organizations, if students get their education through online courses, tapping into any class... any where... any time?

I have been trying to follow and study this trend. So far, it is the universities that are thinking most about this, and they are thinking about it mostly as a technology/marketing problem. I think they should also consider it as a business model problem. The universities (including those with faculty that teach about disruptive innovation) are acting like the incumbents they are, hoping that change happens slowly and gradually and that they can maintain their market position (and tenure). They don't seem to be thinking about what a university will look like when the students don't live here anymore. What about libraries, dorms, and yes, football stadiums (yes, my dear, that is correct plural)? Where should universities be investing? And what about faculty? Or selective admissions?

It seems that many beyond universities should be thinking about this too. What about the communities they serve? Or the businesses that serve student populations or hire university graduates? Are they thinking about what will change if the students don't live in college towns anymore? Not yet.

Friday, March 01, 2013

How to mentor someone

To mentor someone and help them achieve something worthy:

1) Understand who they are, and what makes them itch

2) Support them to unreasonable lengths

3) Challenge them to demonstrate what they really can be/do

4) Help them surprise themselves.

This is my opinion. No facts support this post.

By the way, this is also good advice for how to love someone.

Friday, January 25, 2013

This Is What Disruption Looks Like, Part III

This is cool: Y Combinator just funded its first non-profit, Watsi.

This is cooler: Paul Graham says "I've never been so excited about anything we've funded."

The startup world just shifted a bit.

This is the type of confluence between social entrepreneurship and the startup world I have been hoping for... for a long time. Great to see YC acting on the ideas from Graham's "Be Good" essay from a few years ago.

Others with similar models? Kiva and Vittana have worked in this direction for years, and Watsi's interface looks familiar. Some parallels to Global Giving and Indiegogo, too.

This is coolest: To see a growing number of crowdfunding applications that are built off of Mother Theresa's insight that "If I look at the mass, I will never act. If I look at the one, I will."

_______________

This Is What Disruption Looks Like, Part I

This Is What Disruption Looks Like, Part II

WSJ article from 1/28 entitled: "Non-profit Startups Are Just Like Their Counterparts." I don't agree. Guess that will be a future post.

Update: Watsi was featured in the NY Times on 4/13/13

Tuesday, January 15, 2013

LBO: Liquidity, Legacy, Exit 2.X

It's a thorny issue. An entrepreneurial team builds a company with a great products, an iconic brand and strong vision, values and mission. In the process of doing so, they create value. Lots of it. They finally see a pot of money at the end of the rainbow. It is a just reward for years of hard work, long hours, and ever present fear of failure. Liquidity beckons.

Typically, there are two solutions for this fortunate business: to sell all the company (acquisition) or part of it (IPO, etc.). And that's the rub. In both of those cases, you will likely lose what it is that got you there. Because along with all that hard work, long hours and fear of failure came the joy of building something different, the relationships forged in tough times together, the fun of celebrating the wins along the way. Some entrepreneurs are happy with these two choices, cash out, and then look for their next adventure. But others find this choice perplexing. Is there another way? Is there a way for the entrepreneurs to receive a fair price for the value they have created, yet not give up the soul of the company? Legacy beckons.

Which of these divergent paths to take?

This is a big issue for two reasons. First, if the only exit paths are financially driven, then the implications for mission driven companies are discouraging. There are some well known sales of mission driven companies: Ben & Jerry's sale to Unilever, Tom's of Maine to Colgate-Palmolive, Burt's Bees to Chlorox and Seventh Generation to, well, that's a whole 'nother story. But it is hard to find models of successful exits, if your yardstick has any dimensions beyond shareholder return. Some noble intentions, but little long term success and happiness on both sides of the table. The role models for exit version 2.x are limited to piecing together the "best of" components of deals that have come before.

Second, looking over the horizon, there are many more transactions to come. As Marjorie Kelly notes, "the moment of Founder Departure is about to occur on a massive scale," with the pending retirement of baby boomer entrepreneurs. She reports that while 50,000 companies changed hands in 2001, that number had shot to 750,000 by 2009, and was expected to continue to grow as boomers age.*

Figuring out alternative paths to exit matters.

There are several intriguing alternatives out there. Paths less travelled, but paths with a destination of long lasting legacy. There are ESOPs, where employees own all or part of the company in a trust for their retirement. These are used by some pretty big companies, like Publix with over 150,000 employees. A few years ago, the founder of Bob's Red Mill used this structure to give his company to his employees for his 81st birthday. In her book, Kelly describes other possibilities for "mission-controlled" companies, too- such as foundation controlled corporations (Novo Nordisk) or supplier controlled cooperatives (Organic Valley).

Becoming a B Corp (or benefit corporation), is another piece of the puzzle. All companies can seek to be certified by meeting social/environmental performance goals and transparency standards. Some notable B Corps are Patagonia, Method, Etsy, and recently, the aforementioned Ben & Jerry's. Now, the legal status of a benefit corporation is available to companies in 12 states, and more, including Colorado, are on the way.

Two companies that have combined these- 100% employed owned and B Corp certified- are King Arthur Flour and Dansko.** The reason for this rare combination was well stated by Dansko co-founder and CEO Mandy Cabot:

“Dansko is our baby; our employees are our family. Becoming an employee-owned B Corp protects our legacy, ensuring that we can not only remain independent, but also maintain our focus on being a great place to work, a valued member of our community, and a good steward of the environment.”***At New Belgium Brewing, the company faced the liquidity/legacy quandary. By building a strong brand in a growing business, the company had created great financial value. While already an employee owned company, the ownership was split with the ESOP owning a minority of the company, and the founders and executives owning the majority, and over time this was creating some pressures with respect to newer employees joining the ESOP. As a board, we struggled with the issue of unlocking the value that had been created, without sacrificing the values that had driven it or the future of our co-workers.

At the end of last year, we took the plunge, and joined the small ranks of companies that are fully employee owned B Corps. We announced the change of ownership at yesterday's all staff meeting in Fort Collins. You can get more details here. Basically, the company borrowed enough money to pay the shareholders a fair price for their shares, and the ESOP ended up owning 100% of the outstanding shares. An LBO of sorts- but rather than a Leveraged Buy Out on Wall Street, it is a Legacy Buy-Onward on Linden Street.

We kicked off the meeting with a talk by Jack Stack, whose book The Great Game of Business, had helped shape New Belgium's high involvement culture and open book management. Kim Jordan, co-founder and CEO, then took the stage. Employees were handed an envelope and a beer (hey, it is New Belgium, and it was past beer-thirty). Kim said she had struggled with issues of ownership for some time and had decided to sell control of the company. Co-workers were invited to open the envelope to find the identity of the buyer. Inside was a congratulatory message from all the selling shareholders, and a mirror. The mirror showed every co-worker that THEY were the buyer. It got a bit wild after that! When things settled down, there were some great comments by a few other members of the management team, and our ESOP trustee. Kim then assured the crowd of her continued high involvement in the company, and closed with the following:

"We have been on a long journey to look at a number of options for ownership, with a focus on who would best perpetuate what has been started, and innovate as we grow. We looked at alliances, going public and being acquired. In the end, we felt that the best people in the world to take the business forward were the ones who had taken it to this point: our co-workers. It is with great confidence that we start this next chapter in the New Belgium story, one that we all get a hand in writing."At New Belgium, we have made a deliberate decision to keep ownership in the hands of people we know and trust as a way to achieve liquidity and pursue legacy. We don't know how it will all turn out, and whether this is a path that will work for other companies. We hope so, and we will work to share our experiences with those that are interested in looking down alternative paths. Perhaps others will join us, or follow us, and these paths will become smoother, more obvious and better traveled.

We celebrated last night, and resume the journey today. It is on the path less travelled, and we hope that will make "all the difference." ****

__________________

NOTE: for my less regular readers, I have been on the New Belgium board since 2006.

* Kelly, "Owning Our Future" (2012) p 174.

** Another intriguing model is the worker cooperative B Corp from our Colorado neighbor Namaste Solar.

*** Gilbert & El Tahch, " 'B' A Better ESOP" (2012)

**** Robert Frost, "The Road Not Taken" (1920)

Saturday, January 05, 2013

Read Ross (on Redesigning Demo Day)

Nice post by Ross Baird of Village Capital about keeping the focus of new ventures on customers.

Excerpt: " In some ways, the “demo day” approach is counter-productive: entrepreneurs begin serving two masters– building products for “what investors want” on stage, while trying to build products for “what customers want” in their day job."